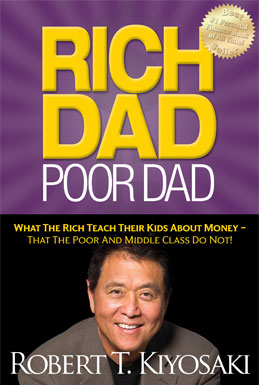

Here are a few great ways you can not only save some money this month but also start teaching kids about money management. Include your kids on your plans for cuttings costs for the month and have them help out with keeping track of money girl.

1. Check your cable and cell phone bill. There may be subscriptions you are paying for each month that are not used too often. Sit down with your kids and discuss where you can save on some of these costs.

2. If you stop for coffee in the morning, cutting out that $5 latte may be another great way to show kids how making little changes can really add up.

3. Make the grocery list with the kids involved and stick to that list when you go shopping. Have your kids look through the weekly coupons to try to cut down on food expenses.

4. De-clutter your home and earn some by selling things on eBay or holding a yard sale. Get the kids involved and encourage them to let go of things they rarely use.

5. Give your kids age appropriate research projects to find new ways to make your home more energy efficient. Discuss with them the global implications of wasting energy as well as the hit to the household budget it creates.

Teaching kids about money should start as early as they can have a conversation with you about it. Don't stop instilling your core values and ideals around finances and encourage your kids to develop their own values. A quality financial education must begin at home.

1. Check your cable and cell phone bill. There may be subscriptions you are paying for each month that are not used too often. Sit down with your kids and discuss where you can save on some of these costs.

2. If you stop for coffee in the morning, cutting out that $5 latte may be another great way to show kids how making little changes can really add up.

3. Make the grocery list with the kids involved and stick to that list when you go shopping. Have your kids look through the weekly coupons to try to cut down on food expenses.

4. De-clutter your home and earn some by selling things on eBay or holding a yard sale. Get the kids involved and encourage them to let go of things they rarely use.

5. Give your kids age appropriate research projects to find new ways to make your home more energy efficient. Discuss with them the global implications of wasting energy as well as the hit to the household budget it creates.

Teaching kids about money should start as early as they can have a conversation with you about it. Don't stop instilling your core values and ideals around finances and encourage your kids to develop their own values. A quality financial education must begin at home.